Our tenants manufacture and distribute essential goods the ‘last mile’ of the supply chain to homes and businesses. This is a vital part of the supply chain and demand for such properties vastly exceeds supply.

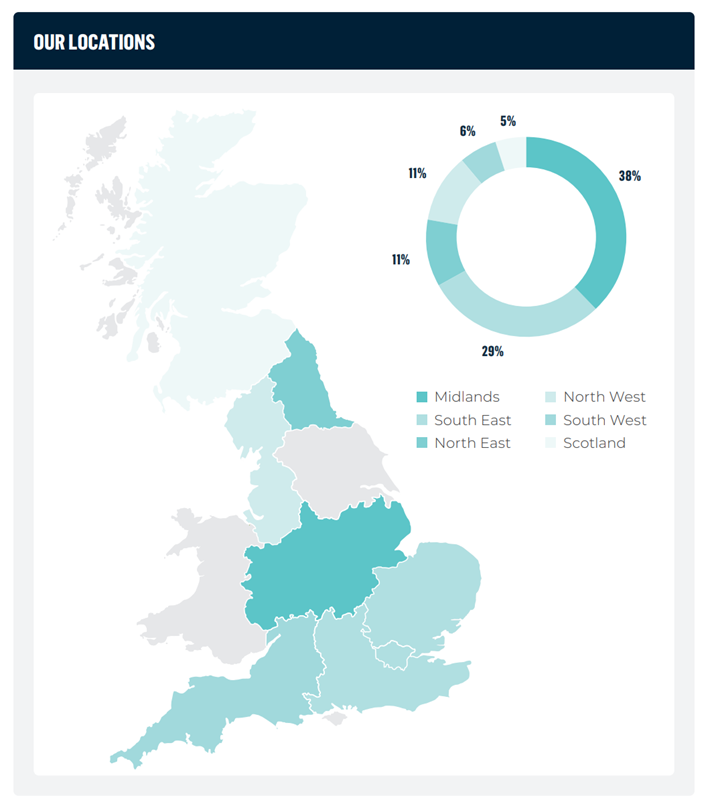

Although our assets are spread throughout the UK, we have a Midlands and South East bias as these are the areas with the strongest take-up of logistics space and are seeing strong rental growth.

We pride ourselves on a close and collaborative relationship with our tenants, founded on regular dialogue and a detailed understanding of their business.

Our business benefits from strong tenant covenants of which 89% are rated as low / low-moderate risk:

- Single-let assets

- High-quality tenants

- Essential goods

- No 'fast fashion' retail